Cryptocurrency API negotiation: how to connect your strategies to exchanges

As the popularity of cryptocurrencies continues to grow, trading platforms that allow users to take advantage of APIs to connect their strategies and run business with greater efficiency and flexibility. In this article, we will explore how cryptocurrency traders can connect their strategies to exchanges using APIs.

What is an API?

Before we dive into the world of cryptocurrency negotiation APIs, let’s quickly define what an API (Application Programming Interface) is. An API is a set of rules that allow different software systems or services to communicate. In the context of negotiation, an API provides a way for developers to create personalized negotiation strategies that perfectly integrate into exchange platforms.

Why use APIs in the cryptocurrency trade?

There are several reasons why traders choose to use APIs in the cryptocurrency trade:

- Flexibility : APIs allow traders to customize their trading strategies using a programming language or script structure of their choice.

- Scalability : When unloading the technical analysis and other tasks of the negotiating platform, API negotiation can deal with high negotiation volumes more efficiently.

3.

4.

How to connect your cryptocurrency negotiation strategies to exchanges using APIs

Here is a step -by -step guide on how to start:

Step 1: Choose an exchange API

Not all exchanges offer API access to all. Some popular exchanges that provide APIs include:

- Binance

- Coinbase pro

- Kraken

- Bitfinex

Each exchange has its own set of requirements, so be sure to review your documentation before connecting your strategy.

Step 2: Register for an API key

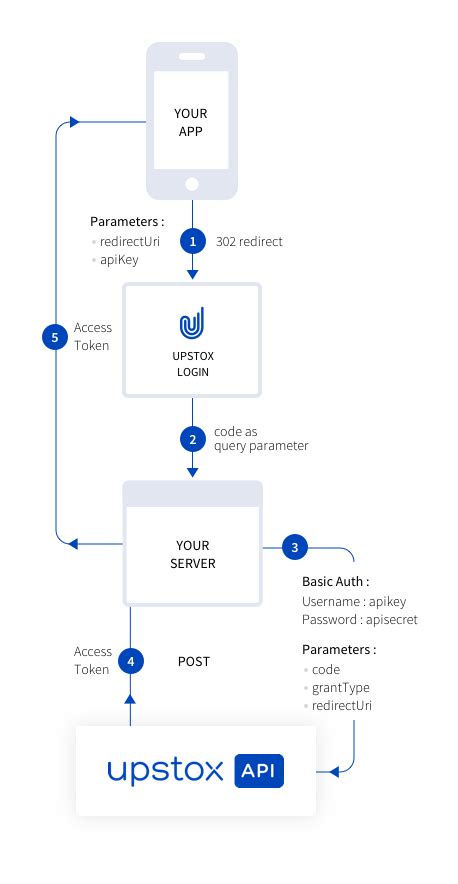

To connect your trading strategy to the Exchange API, you will need to get a key from the API. This usually involves:

- Record in exchange : Sign up for a developer account and create an API key.

- Centering an API key : Follow the registration process on the scholarship website.

Step 3: Install a negotiation library

You will need to install a commercial library that can deal with your trading strategy using the Bolsa API. Some popular libraries include:

* BACKTRADER : A popular Python library for backtesting and negotiating strategies.

* ZIPLINE : A Python Library developed by Quespian, designed for algorithmic negotiation.

Step 4: Define your negotiation logic

Using your library or programming language chosen, define the logic that drives your negotiation strategy. This will involve:

- Defining indicators and signs : Create personalized indicators and signs to conduct your negotiating decisions.

- Setting Risk Sizing and Management : Implement Risk Dimension and Management Strategies using the Scholarship API.

Step 5: Integrate with the Exchange API

After defining your negotiation logic, integrate to the Exchange API by:

- Shipping Requests : Use the library or programming language to send requests to the Exchange API.

- Errors and handling exceptions : Implement errors handling and exception management mechanisms to deal with any problems that arise.

Step 6: Test and Refine

Before performing production negotiations, test your negotiation strategy using a test environment:

- BackTesting : Use historical data to support your strategy for performance, risk and reliability.

- Refine and Itera

: Refine your strategy based on the results of your backtesting exercise.