The Double-Edged Sword of Cryptocurrency: Unpacking the Risks and Opportunities

The cryptocurrency market has experienced a meteoric rise in recent years, with prices soaring to unprecedented heights and valuations reaching stratospheric levels. However, beneath the surface of this seemingly unstoppable growth lies a complex web of risks that could ultimately undermine the very foundations of the industry. This article will delve into the concept of systemic risk, its connection to cryptocurrency market sentiment, and the potential consequences for investors.

What is Systemic Risk?

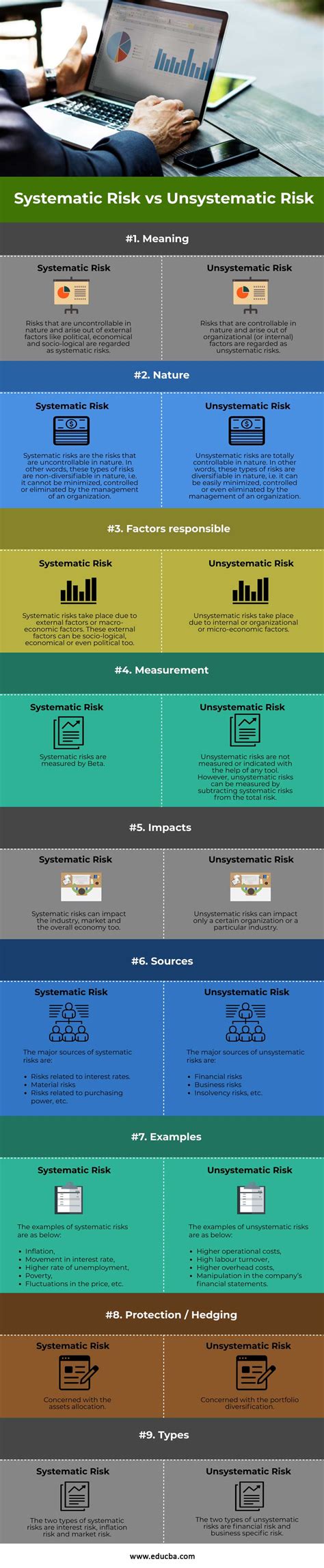

Systemic risk refers to the inherent danger that financial systems as a whole can fail or collapse when individual components are severely damaged. In other words, it’s the threat that the entire system will be disrupted or destroyed, causing widespread instability and potentially leading to a global economic meltdown. This concept has been extensively studied in finance, where it is often referred to as “financial sector risk.”

In the context of cryptocurrency, systemic risk takes on a new and particularly concerning form. The decentralized nature of cryptocurrencies, such as Bitcoin (BTC) and Ethereum (ETH), means that there are no central authorities or financial institutions holding assets – making them inherently more vulnerable to collapse.

The Connection Between Systemic Risk and Cryptocurrency Market Sentiment

Market sentiment is the emotional state of investors, influenced by factors such as news, social media, and market psychology. When it comes to cryptocurrency, market sentiment has been a wild rollercoaster ride in recent years, oscillating wildly between euphoria and despair.

As prices surged, market sentiment was largely optimistic, with many investors believing that the rally was sustainable and that cryptocurrencies would continue to grow in value. However, as prices began to decline, sentiment shifted sharply, with many investors selling their holdings at the peak of the bubble and betting on a crash.

The timing of this shift is particularly concerning, as it coincides with significant increases in global economic uncertainty, such as Brexit negotiations, US-China trade tensions, and rising inflation rates. These events have all contributed to a sharp decline in market sentiment, with many investors now viewing cryptocurrencies as a high-risk, high-reward play that will likely experience severe price drops.

The Potential Consequences for Investors

So, what does this mean for investors who are currently holding or considering investing in cryptocurrency? Here are just a few potential consequences:

- Loss of confidence: If market sentiment continues to shift sharply against cryptocurrencies, it could lead to a significant loss of investor confidence – which could have far-reaching consequences for the entire industry.

- Market volatility: The increased risk of systemic collapse and price drops means that market volatility will likely persist in cryptocurrency markets. This can make investing in cryptocurrencies more challenging and potentially even disastrous for unprepared investors.

- Increased regulatory scrutiny: In light of current concerns over systemic risk, governments and regulators may become increasingly scrutinizing the industry – which could lead to increased regulations and restrictions on trading.

Conclusion

While cryptocurrency has shown remarkable resilience in recent years, it’s essential for investors to approach this market with caution. Systemic risks are inherent to the industry, and market sentiment can shift at any moment, leading to severe consequences.

To mitigate these risks, it is crucial to conduct thorough research, diversify holdings, and stay informed about market developments.